Trump's Return Looms as Dalio Warns of 'De-Dollarization War'

The world is already at war, but not in the traditional sense.

“The world is already at war, but not in the traditional sense.”

That's the stark message from billionaire investor Ray Dalio, founder of Bridgewater Associates, who sees the current global realignment as more than just political posturing. As Trump positions for a potential return to power, investors face a radically shifting landscape of trade blocs, monetary competition, and technological sovereignty.

Dalio's War Thesis

"We are already in a war," Dalio stated in recent communications, pointing to escalating economic sanctions, technology restrictions, and the weaponization of global finance. His analysis focuses on three key battlegrounds:

Financial warfare through currency competition and sanctions: The use of economic sanctions and tariff measures as tools of foreign policy has intensified, affecting the dynamics of global currency flow. Nations are increasingly exploring alternative reserve currencies to reduce reliance on the dollar. This trend is evident in the moves by several countries to settle trade in local currencies or in alternatives like the Euro or Yuan, thereby challenging the dollar’s dominance.

Technology restrictions and intellectual property battles: Restrictions on technology transfer and heightened battles over intellectual property rights are redefining the landscape of global tech leadership. Countries are becoming more protective of their technological advancements and strategic capabilities, leading to a balkanization of technology where compatibility and standards may vary by region.

Strategic resource control and supply chain realignment: The fight for control over strategic resources like rare earth metals, which are crucial for high-tech manufacturing, has led to efforts to secure and diversify supply chains. Countries and corporations alike are reevaluating their supply chains to ensure stability and reduce dependence on potentially hostile partners.

The veteran investor draws parallels to historical power transitions, particularly the 1930-45 period, when established powers faced rising challengers amid monetary instability.

The Rise of Trade Blocs

Global trade is fracturing into distinct spheres of influence:

A U.S.-led bloc emphasizing "friend-shoring" and technological restrictions aims to strengthen ties with allies through shared supply chains and technology standards. This bloc focuses on reducing dependence on adversaries for critical technologies and goods.

A China-centered economic zone extending through the Belt and Road Initiative seeks to expand influence through infrastructure investments and trade partnerships across Asia, Africa, and Europe.

Regional arrangements like ASEAN seeking to maintain strategic autonomy are crafting policies that preserve their own interests amidst the tug-of-war between larger powers.

This fragmentation represents more than simple protectionism. It signals a fundamental shift in how global commerce operates, with implications for everything from semiconductor manufacturing to commodity pricing.

Dollar Dominance Under Threat

The USD's reserve status, long considered unassailable, faces unprecedented challenges. Recent data shows central banks reducing dollar reserves at the fastest pace in decades:

Saudi Arabia considering yuan for oil sales hints at significant geopolitical shifts and the potential for a new oil trade currency standard.

BRICS nations developing alternative payment systems reflect an effort to de-risk from the dollar and foster greater economic cooperation among emerging economies.

European moves toward strategic autonomy in financial infrastructure are aimed at reducing dependency on U.S. financial systems, evidenced by the development of alternative payment and settlement mechanisms.

These shifts coincide with record U.S. deficits and mounting Treasury issuance, creating what Dalio terms a "classic late-empire dynamic."

Global Debt and Economic Shifts

The global debt crisis exacerbates these tensions, with countries like the United States facing unparalleled debt levels, influencing global financial stability. As nations grapple with these debts, the fragility of relying on a single global reserve currency becomes more apparent.

China's Economic Influence

China's rapid GDP growth has positioned it as a formidable global player, challenging the economic dominance of Western powers. With strategic investments through its Belt and Road Initiative, China has not only expanded its influence across Asia, Africa, and Europe but also solidified its role in global trade and economic policy. This growth, coupled with China's increasing involvement in international organizations, suggests a strategic shift towards a more multipolar global economy.

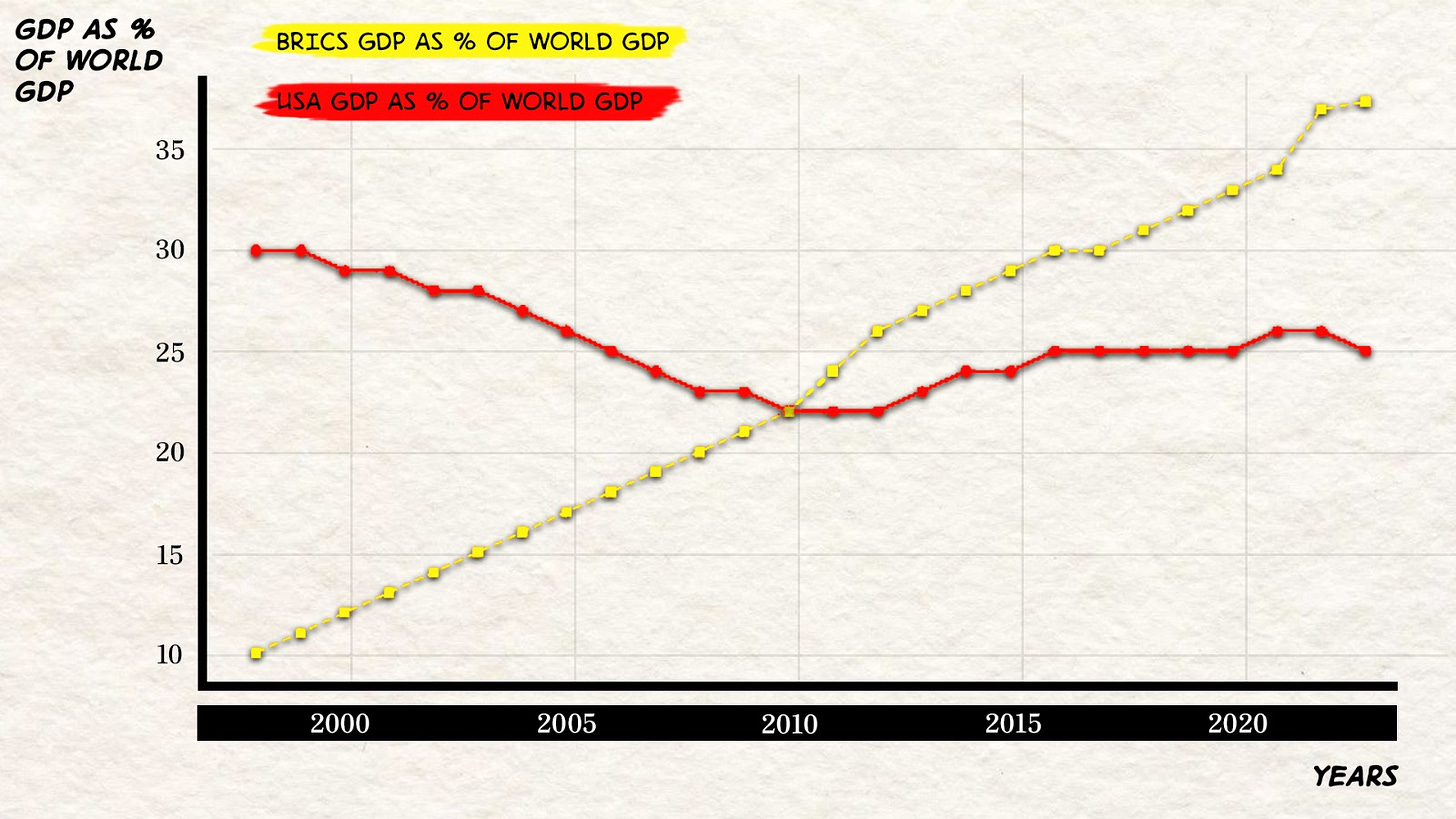

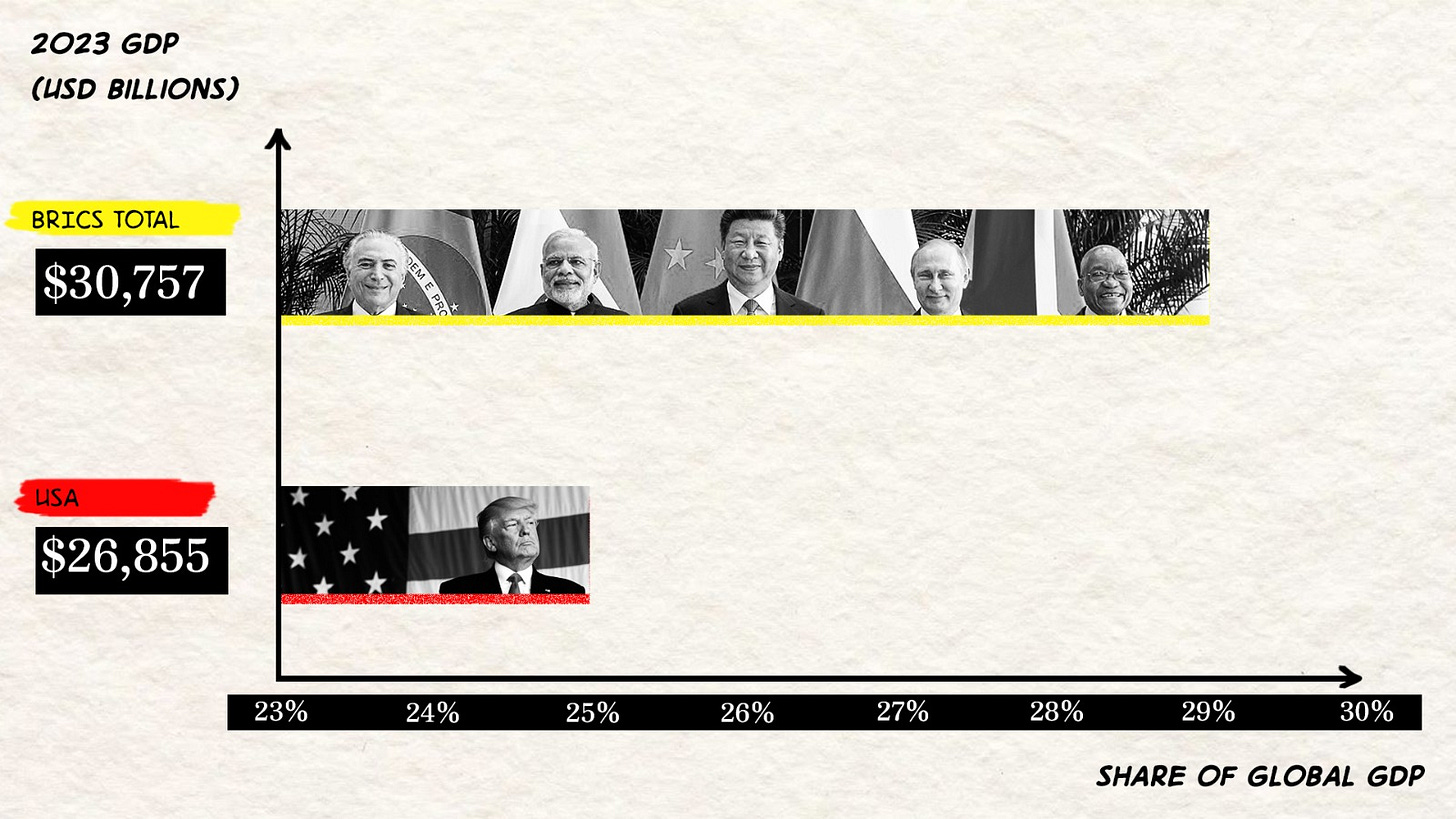

BRICS Expansion and Global Alignment

The expansion of BRICS (Brazil, Russia, India, China, and South Africa) and their call for more inclusive global governance resonate worldwide. Recent discussions about expanding BRICS include nations from various continents, which could significantly shift global alliances. These nations together represent a significant portion of the world's population and GDP, indicating a substantial shift in global economic alignments away from traditional Western-centric models.

Trump Factor: Policy Shift Ahead?

A potential second Trump presidency adds another layer of complexity. His campaign promises of increased tariffs and aggressive trade policies could accelerate the formation of competing economic blocs. Key considerations include:

Proposed 10% universal tariff implications: Such tariffs could lead to higher costs for American consumers and retaliatory actions from trade partners, potentially leading to a trade war that could stifle global economic growth.

Potential acceleration of friend-shoring initiatives: By incentivizing U.S. companies to move their supply chains closer to home or to allied nations, these initiatives aim to enhance economic security but may increase operational costs.

Impact on global supply chain reorganization: Companies worldwide may need to navigate a more complex regulatory environment, prompting a reevaluation of global operations to mitigate risks associated with geopolitical tensions.

Investment Implications

This new environment demands strategic repositioning:

Asset Allocation

Smart money is increasingly looking toward:

Physical gold and strategic metals as hedges against currency devaluation and economic instability.

Companies controlling critical resources, which are poised to gain from supply chain realignments and protectionist policies.

Multi-jurisdictional investment structures to mitigate risks associated with specific country exposures.

Geographic Diversification

Sophisticated investors are:

Spreading assets across stable jurisdictions to avoid concentration risks in any single country.

Developing alternative banking relationships to ensure access to multiple currencies and financial systems.

Implementing robust legal structures to protect assets from sovereign risks and ensure compliance with an evolving regulatory landscape.

Market Repricing Risk

Current U.S. equity valuations may not fully reflect these structural shifts. The S&P 500's elevated multiples assume continued dollar dominance and stable global trade—assumptions increasingly under question.

Strategic Response

For high-net-worth investors, the implications are clear:

Portfolio resilience through geographic diversification ensures exposure to a variety of markets, reducing potential risks from any single geopolitical or economic event.

Strategic allocation to hard assets provides a buffer against inflation and currency risks.

Sophisticated legal and banking structures enhance asset protection and flexibility in response to changing tax and regulatory environments.

Access to multiple liquidity sources ensures readiness to respond to financial opportunities or obligations as they arise.

Looking Ahead

The transition to a multipolar world creates both risks and opportunities. As Dalio notes, "Understanding and adapting to these shifts will be the key determinant of investment success in the coming decade."

Grey River Advisory Services

For high-net-worth investors seeking guidance on navigating this changing landscape, Grey River offers sophisticated solutions in:

International wealth structuring to optimize for tax efficiency and compliance.

Strategic asset allocation tailored to individual risk profiles and investment goals.

Cross-border estate planning to protect and preserve wealth across generations.

Precious metals acquisition, providing tangible assets that historically appreciate during times of uncertainty.

Contact us for a confidential consultation on protecting your wealth in an increasingly complex world.

Schedule Consultation by contacting us at info@grey-river.com or contacting our team at (786)453-1999